With the bustling energy market in 2023, you probably thought of beginning a side freelancing career or might have had people telling you to join the freelancing economy. Freelancer - also known as an independent contractor or gig worker earns their income on a project basis, with rates being determined by the freelancer themselves.

Did you know it takes as little as 3-5 days to set up your own sole proprietorship? In Malaysia, freelancers can register their businesses at Ezbiz's website for MYR 40 (as of 2023). As a freelance marketplace that exists to give you career freedom, Trees Engineering is all about helping you find your way as a freelancer. Today, we’re taking you through a step-by-step guide on how to become a real freelancer in Malaysia.

- Create an account

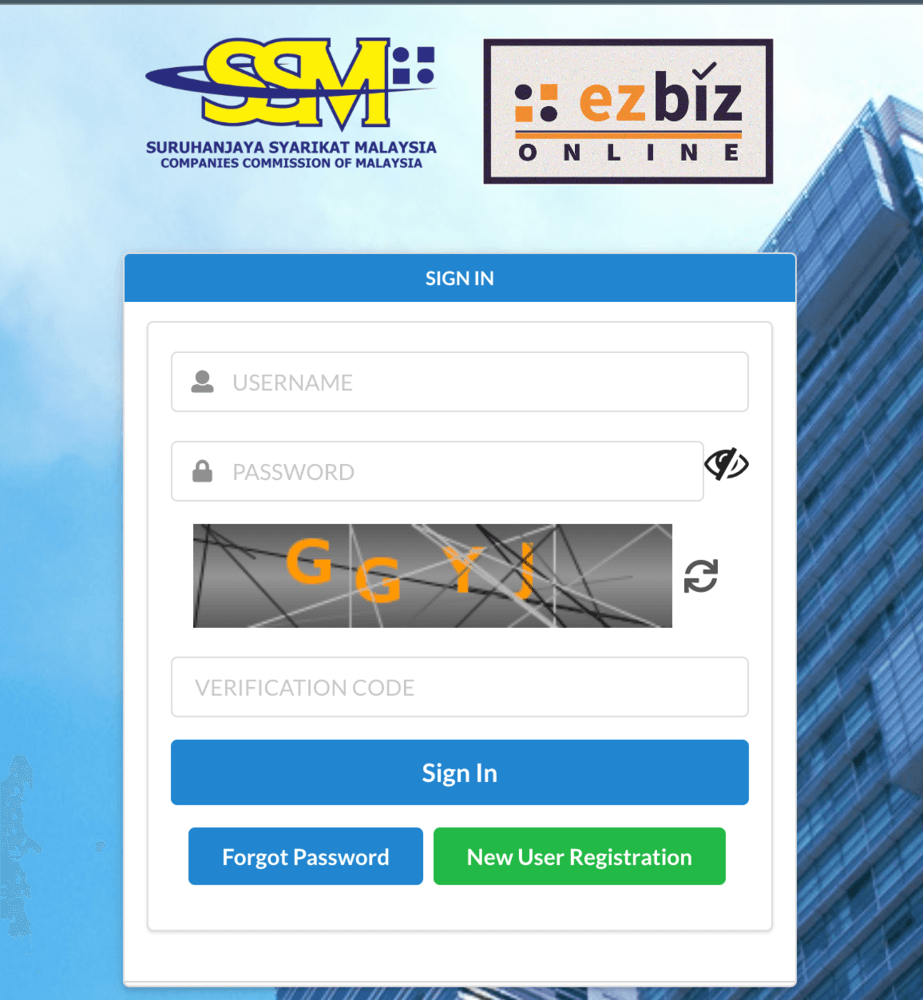

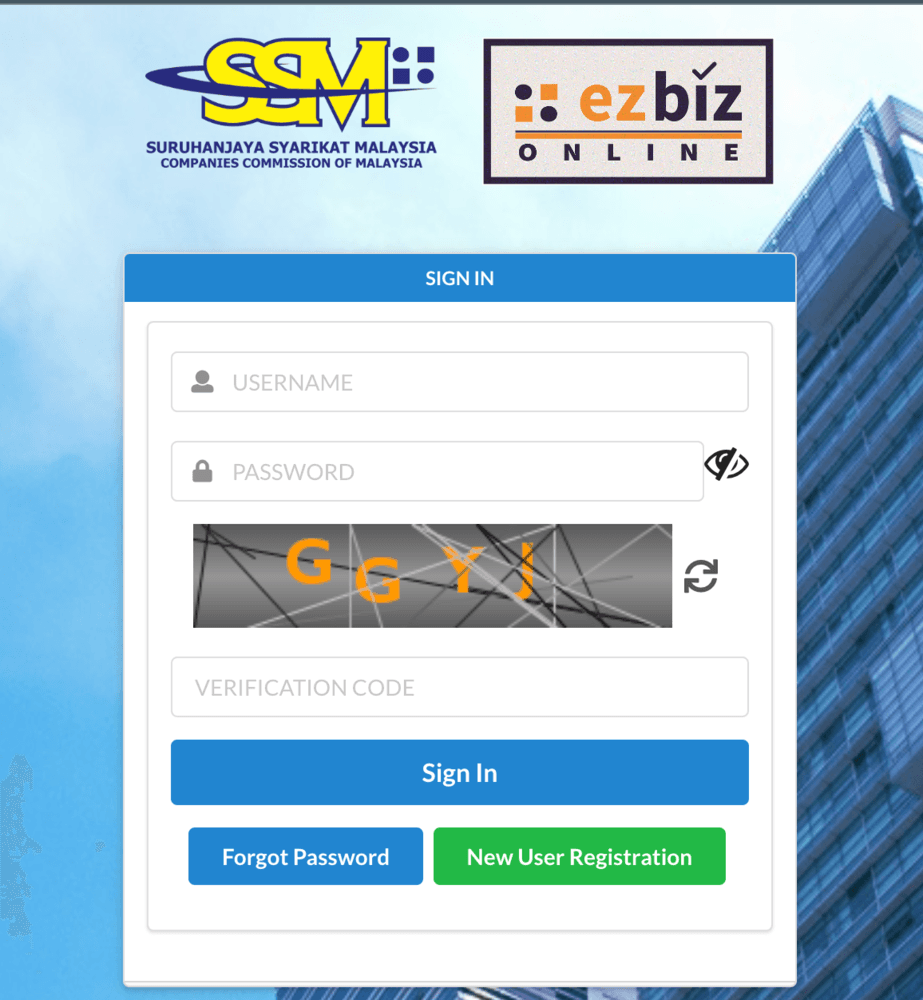

Go to Ezbiz's website and click on “New User Registration”

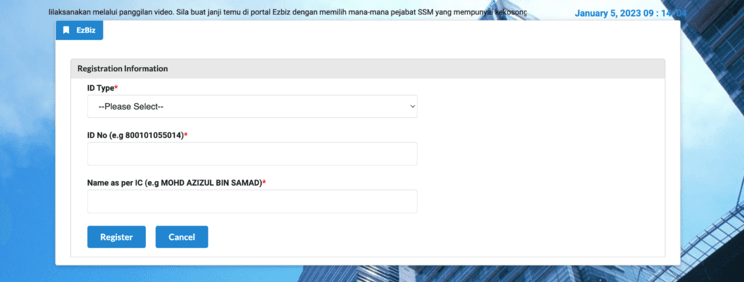

Insert Identification card (IC) information

Create your username, password and email

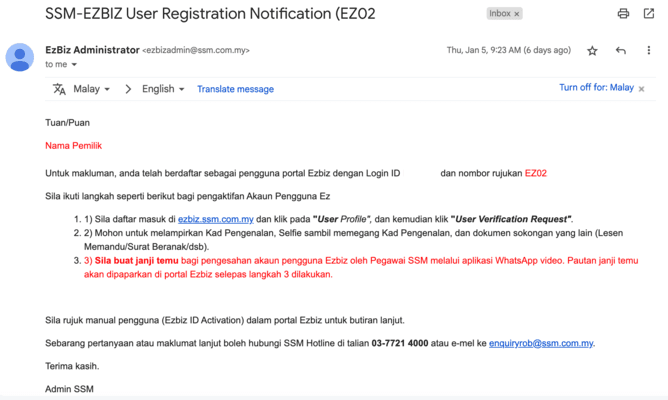

Receive an email notification on your user registration

2. Verification process

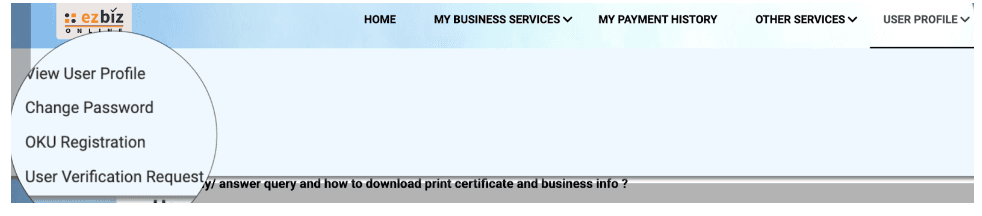

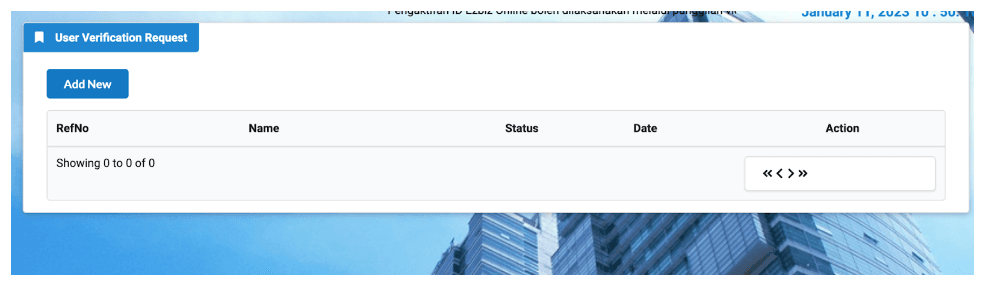

Go to your profile at Ezbiz's website

Click "User Verification Request"

Click "Add New"

Insert the requested details such as Mykad, a selfie with an identification card and supporting documents.

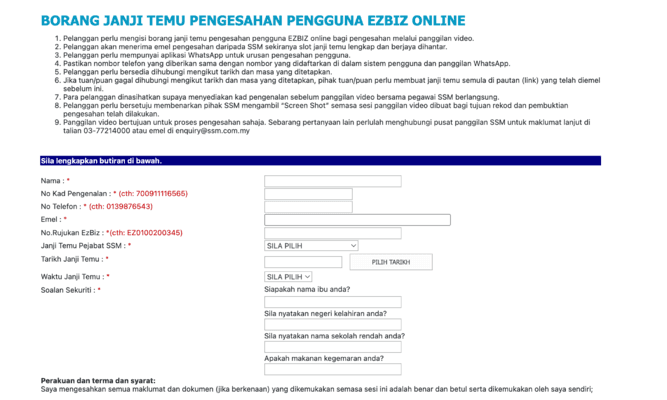

3. Book a WhatsApp Video meeting

Select the date, time and office that you would like to speak to

Receive an email confirming your selected meeting slot

4. Attend The Meeting

The video call will be relatively fast and conducted through WhatsApp for 2-3 minutes. The SSM officer will require you to read your IC number and ask you to hold your IC neck level before they take a screenshot.

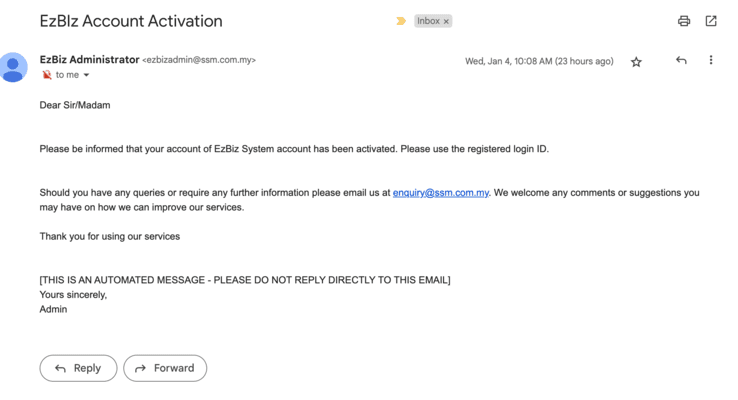

Receive an email stating your account is activated

5. Your Account Is Activated

Almost there! This doesn't mean you’re done. At this stage, you need to include other information and make payment.

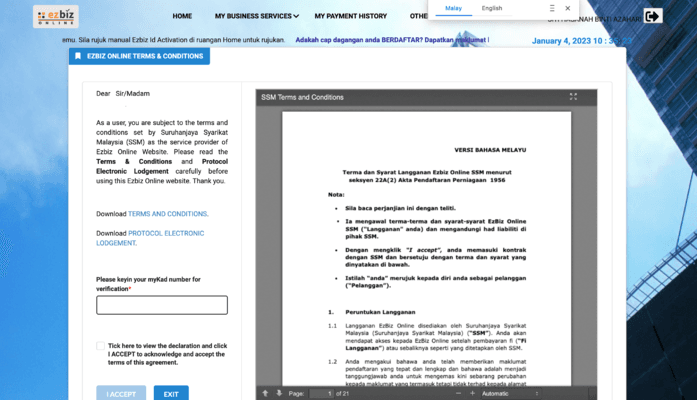

Login to your account and sign the TNC

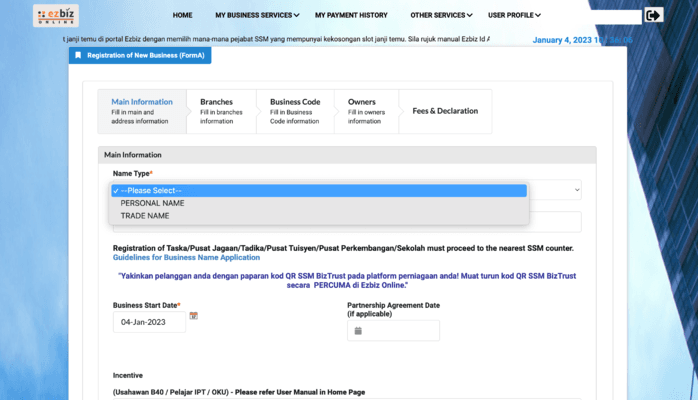

6. Company registration

Fill in your company name

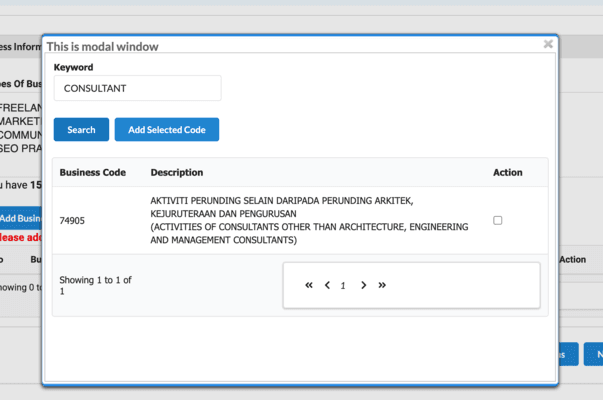

Select the business code related to your company

Insert the owner's information. At this stage, you can also opt to add shareholder details (if any)

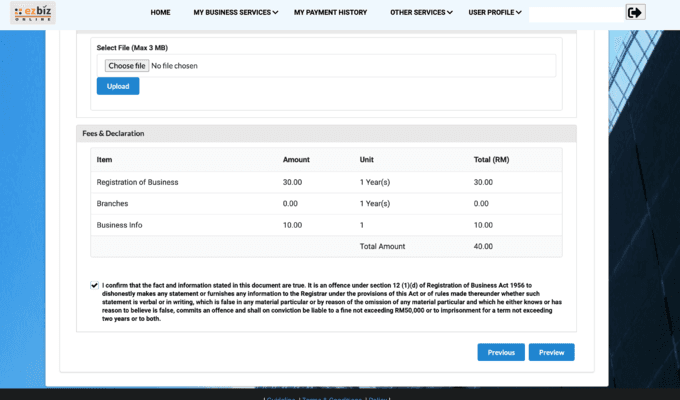

7. Payment

You will be charged MYR 30 for registration of the business and MYR 10 for business information. Note that surcharges are applicable for business partners. Afterwards, choose to pay via SSM physical counters or online.

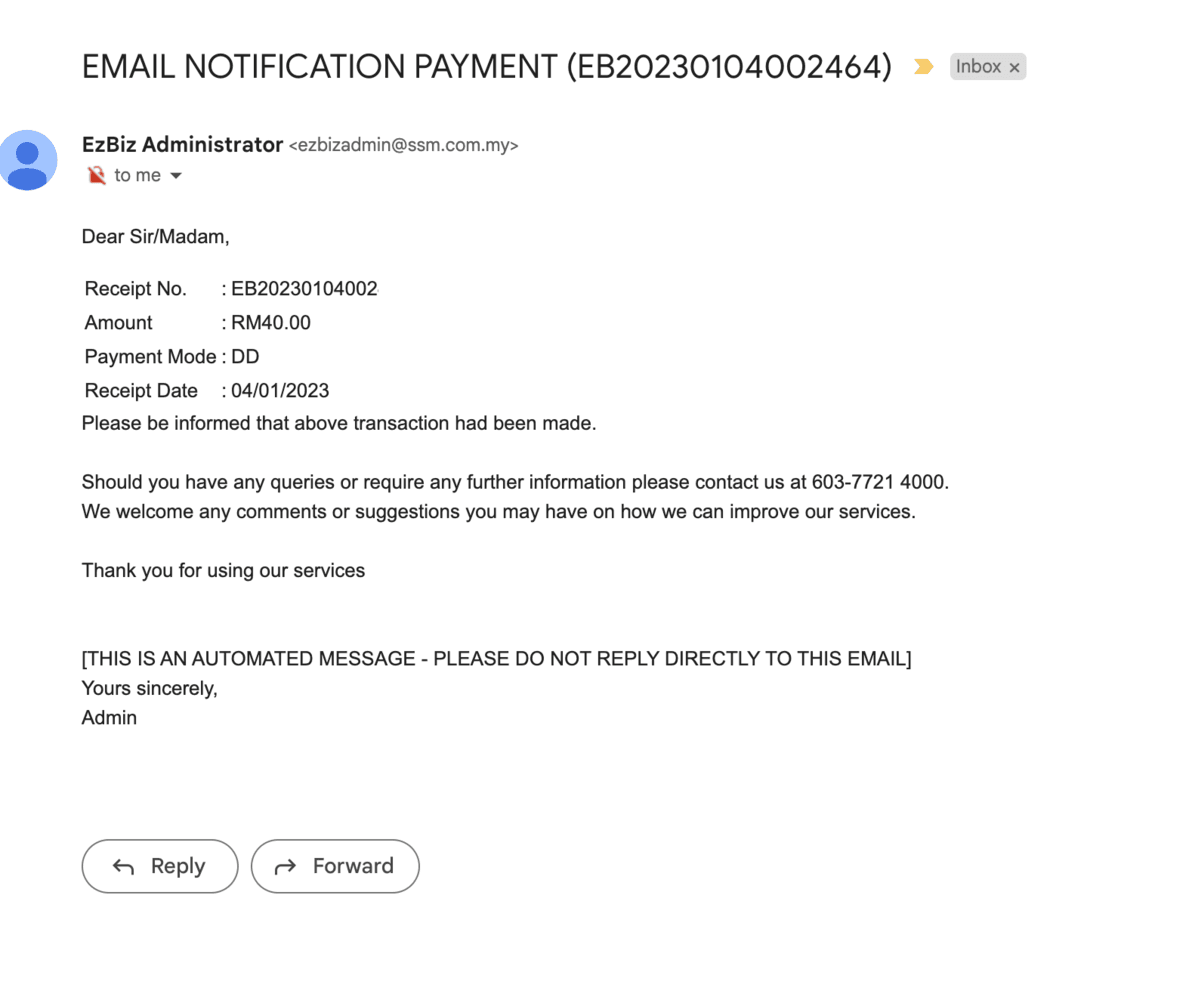

After payment is made, you will receive an email such as below:

8. Your Application Is Submitted

Your application for a sole proprietorship has now been submitted! Note that it will take a few days before an update email informing you of your application status comes along.

After your application status is accepted, you will receive an acceptance email.

9. Login

Congratulations! You can now log in and access your SSM certificate for your use.

What Happens If I’m An Unregistered Freelancer?

If you’re thinking of doing side missions on a casual basis without being registered, proceed with caution. According to the ROBA 1956, anyone who conducts business without registering a business is guilty of the offence and faces a maximum fine of RM 50,000 or a maximum sentence of two (2) years in prison, or both, in Malaysia.

Is My Freelancing Income taxable?

Yes, however, the government had stated that income from businesses that are not based in Malaysia or registered there is not subject to Malaysian income tax back in 2005 (YA 2004). So, if you've been accepting employment from foreign firms, these earnings may be exempt. However, make sure to keep documents, such as invoices and receipts, as proof that your income is directly related to business operations carried out outside of Malaysia. If you are unable to do so, the income will be deemed as Malaysian-derived income.

Note that the government had proposed to eliminate this tax exemption for income from foreign sources under Budget 2022, but the decision was later overturned. As a result, the exemption will continue to be available to those affected from 1 January 2022 to 31 December 2026.

To lower your taxable income, as a full-time freelancer, you may want to take advantage of the EPF Voluntary Contribution (i-Saraan) programme and the Self-Employment Social Security Scheme (SESSS). For self-employed people, the SESSS and i-Saraan contributions are essentially the same as the Social Security Organisation (SOCSO) and Employees Provident Fund (EPF) contributions (including freelancers).

To make sure you are up to date with the most recent standards adopted, always check the Inland Revenue Board's (LHDN) taxation guidelines on e-commerce and visit www.trees-engineering.com for freelancing opportunities.